Table of Content

Contact your lender, your financial advisor, and/or a housing counselor for advice or information related to your specific situation. Loan Look-Up Tool To understand your options for assistance, it’s important to know who owns your loan. Find out which loan is better for your housing goals by using our loan comparison calculator. The loan amount is the amount of money you plan to borrow from a lender.

Transfer taxes range widely by location because they're applied... In some markets, you are required to hire a closing attorney as part of the selling process. The cost of a closing attorney deducts an additional $800-$1,200 from your profit. Sellers usually pay both their listing agent's commission and the buyer agent's commission charges, generally 2-3% of the home sale price per agent.

Homeowners May Want to Refinance While Rates Are Low

Because the tax benefits are usually not seen until you get your tax return, if may be wiser to take this conservative approach when figuring out what home expense you can afford. The spreadsheet contains definitions for some of the terms in the cell comments. You can also read more about some of the specific expenses resulting from home ownership below the download block. Add in builder incentives and warranties, and you are likely saving money when you buy new.

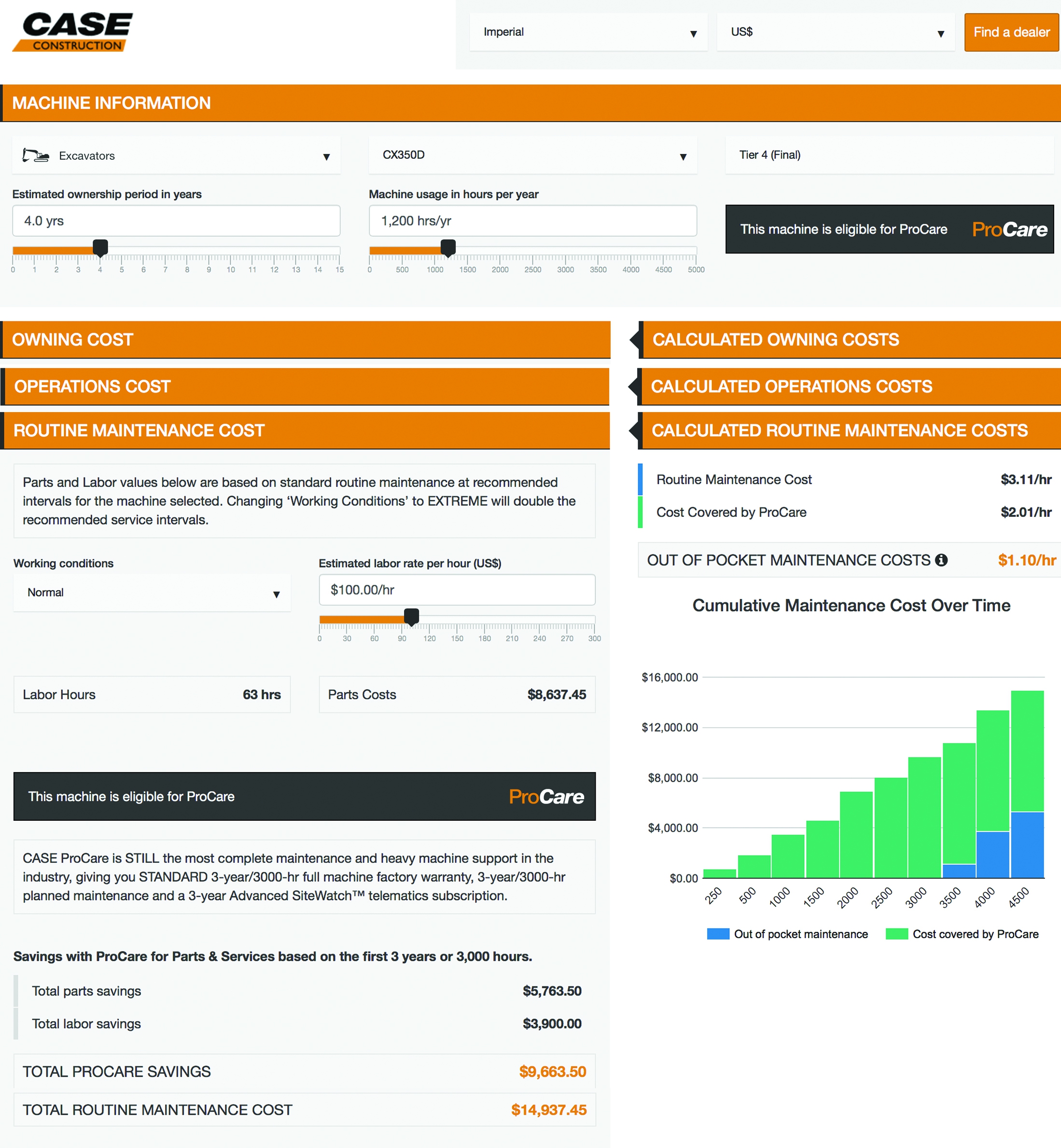

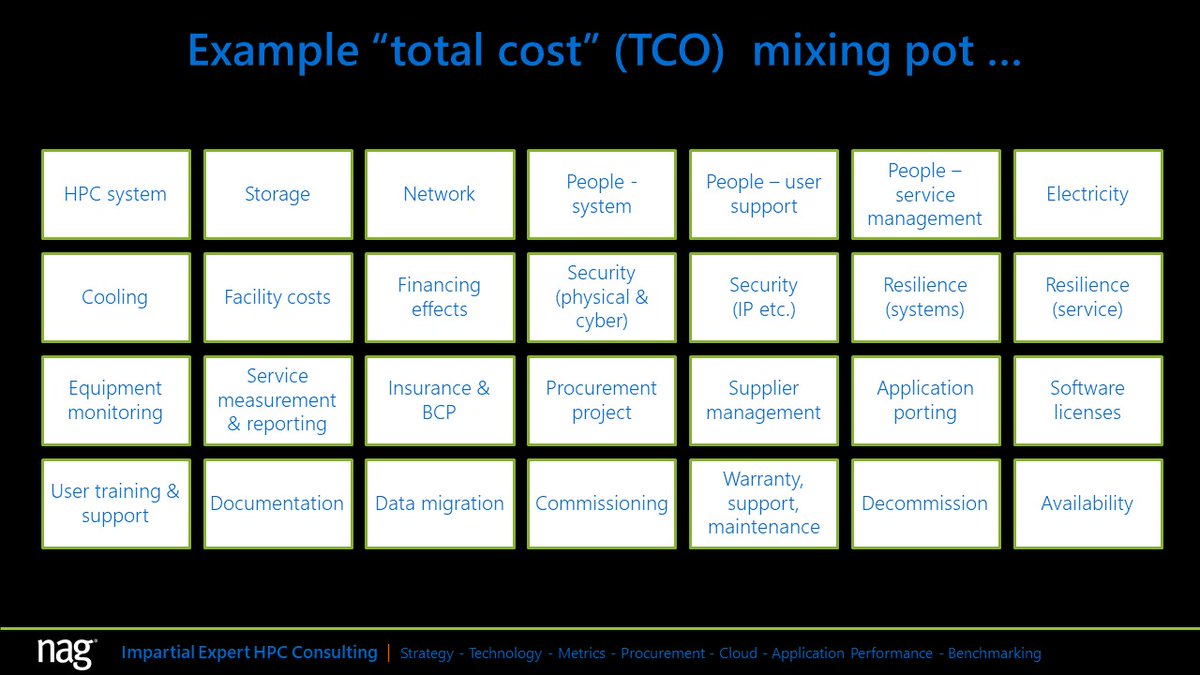

The initial sum attached to your loan is broken down into repayment obligations stretching over years. Payments are divided into manageable chunks, each coming due at pre-arranged intervals. When looking at the total cost of ownership, be sure to calculate energy costs, maintenance, and repair fees. If you are a current homeowner who has built up equity in your home, you may want to access that equity to cover some of those costs of home ownership. One option is a home equity agreement , which provides a lump sum from your available equity upfront in exchange for a portion of your home’s future value. Homeownership costs can extend beyond the purchase price and related expenses explained above.

Ally Tools & Tips

Frugal drivers hedge ongoing vehicle expenses by purchasing cars they can afford to buy with cash on hand. Most often though, additional financing is required to pay purchase prices. An adjustable-rate mortgage or ARM has an interest rate that can change. Your monthly payments can go up or down with this type of mortgage. Finally, your cost of home ownership will include the price for repairs and necessary maintenance.

You’ll need to budget for utility expenses, including water, electricity, gas, and the internet. The average monthly cost of utilities for a home is about $290, though some states pay higher utility bills than others. For example, Hawaii, New Hampshire, and Connecticut pay an average of over $350 a month. The average cost of homeowner's insurance per year is $1,500, but the location, size, and condition of the home will play a large factor in the price. Above all, banks assess the risk of your home becoming damaged by things like wind, rain, and fire and will require additional flood insurance in some regions. Let's not forget that you need to get from point A to point B when you buy a new home.

year or 30-year Term?

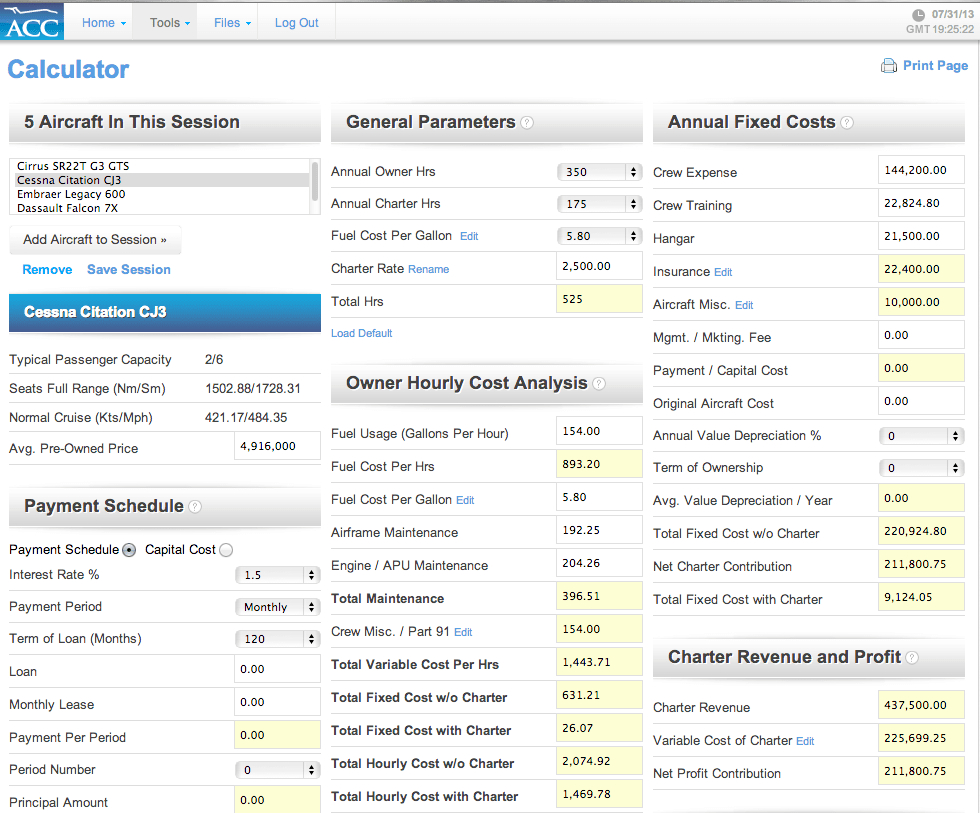

Payments are usually made monthly — a portion pays down the principal and the remainder goes toward interest charges. Some lenders require you to pay your property taxes and your homeowner’s insurance as part of your mortgage payment. Find out all the cost components that make up a typical mortgage and use our calculator to get an estimate of your monthly mortgage payment.

At the end of the year, you deduct the interest from your taxable income, reducing your overall tax burden. Therefore, if your taxable income is $50,000 and you paid $5,000 in mortgage interest, your taxable income would be reduced to $45,000. Your taxes will then be calculated based on the appropriate percentage of your income for your tax bracket. The above rates are separate from Federal Insurance Contributions Act taxes which fund Social Security and Medicare. Employees and employers typically pay half of the 12.4% Social Security & 1.45% Medicare benefit each, for a total of 15.3%. If you buy property in a homeowner association , you’ll likely have monthly or quarterly fees.

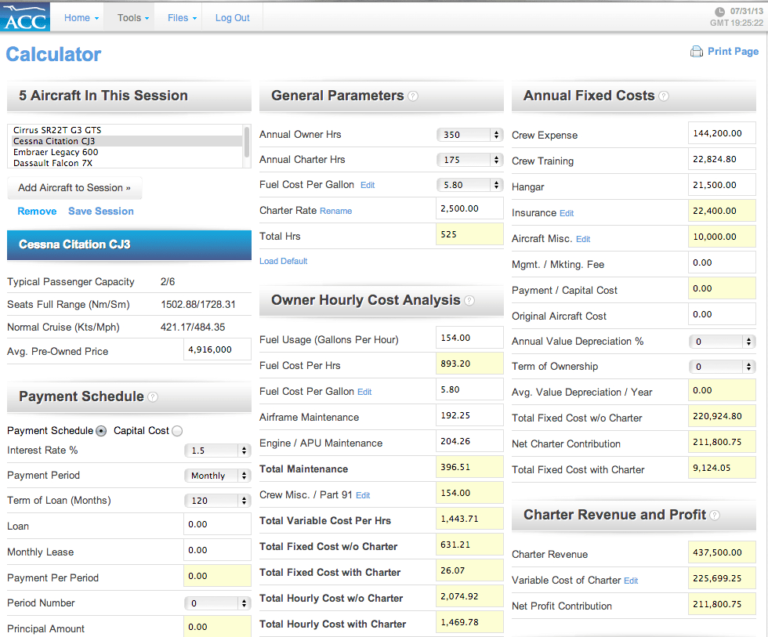

Potential buyers can input their income, current bill payments and perhaps property tax rates and insurance costs, and the calculator kicks out an estimate of what they should be able to spend on a home. Any homeowner knows just how rare it is to find a hole in your finances where owning a home, paying a mortgage, and being a loan owner actually saves you money. But when it comes to paying off your taxes, many homeowners will be able to save quite a chunk of cash, much to their delight. This savings is due to the generous ability that the IRS gives mortgage payers to deduct both interest and property tax payments from their gross income.

A rent increase is when your landlord raises the rent you pay each month. Home value is the estimated amount your home is worth in the current market. Affordability calculator Calculate the price of a home you can afford.Loading... Refinance calculator Decide if mortgage refinancing is right for you. Don’t miss out on the R&D tax credit Many manufacturers are eligible, but only 1 in 20 claim it. You may be surprised about what qualifies as research and development.

However, only taxpayers who itemize can take advantage of this benefit. HOA fee—a fee imposed on the property owner by a homeowner's association , which is an organization that maintains and improves the property and environment of the neighborhoods within its purview. Condominiums, townhomes, and some single-family homes commonly require the payment of HOA fees. Annual HOA fees usually amount to less than one percent of the property value. Many lenders require PMI when down payments are less than 20 percent of the purchase price.

Because this deduction has many complex rules, it is important that you work with a certified tax professional to determine exactly what it is permissible for you to claim. Working with a tax professional is also advisable when you are making other mortgage deductions, such as your interest or property taxes. An accountant can help you ensure that you are taking the full deduction for which you qualify so that you can maximize your tax benefits. The interest rate discount is also available for owners of one or two homes, multiple mortgages, and those who have lines of credit or home equity loans. Only the primary borrower – or primary borrower and related spouse – can claim the deduction. Traditional homes, condominiums, mobile homes, boats, recreational vehicles, and cooperatives are all eligible to qualify for the interest rate deduction.

The golden rule used to be that down payments must be 20% of the purchase price, but that’s no longer a steadfast expectation. Today, a variety of financing options and programs are available. Many are geared toward low- to moderate-income borrowers to allow a wider range of access for buyers considering homeownership. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage. If you are itemizing deductions on your tax return, then you will probably be able to deduct mortgage interest and property taxes.

This cost varies greatly based on where you live, but on average, a typical homeowner pays around $2,400 a year in property taxes. Make extra payments—This is simply an extra payment over and above the monthly payment. On typical long-term mortgage loans, a very big portion of the earlier payments will go towards paying down interest rather than the principal. Any extra payments will decrease the loan balance, thereby decreasing interest and allowing the borrower to pay off the loan earlier in the long run.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards. Miscellaneous—new furniture, new appliances, and moving costs are typical non-recurring costs of a home purchase. Many builders offer home warranties, or provide warranties purchased from an independent company that assumes responsibility for certain claims. Most warranties on new construction cover siding and stucco, doors and trim, and drywall and paint during the first year, while coverage for HVAC, plumbing and electrical systems is generally two years.

No comments:

Post a Comment