Table of Content

A mortgage is a loan secured by property, usually real estate property. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S. A portion of the monthly payment is called the principal, which is the original amount borrowed.

Your home equity is your current home value minus what you owe in your mortgage. Here are the most common maintenance costs to expect when you own a home. If you are part of a homeowner's association, you may pay between $200 and $300 per month in dues. These associations perform various duties, from providing community amenities to resolving legal disputes with neighbors. If you are paid as a contractor you may receive compensation on a 1099-MISC form. Self-employed people pay self-employment taxes, which had them paying both halves of the tax.

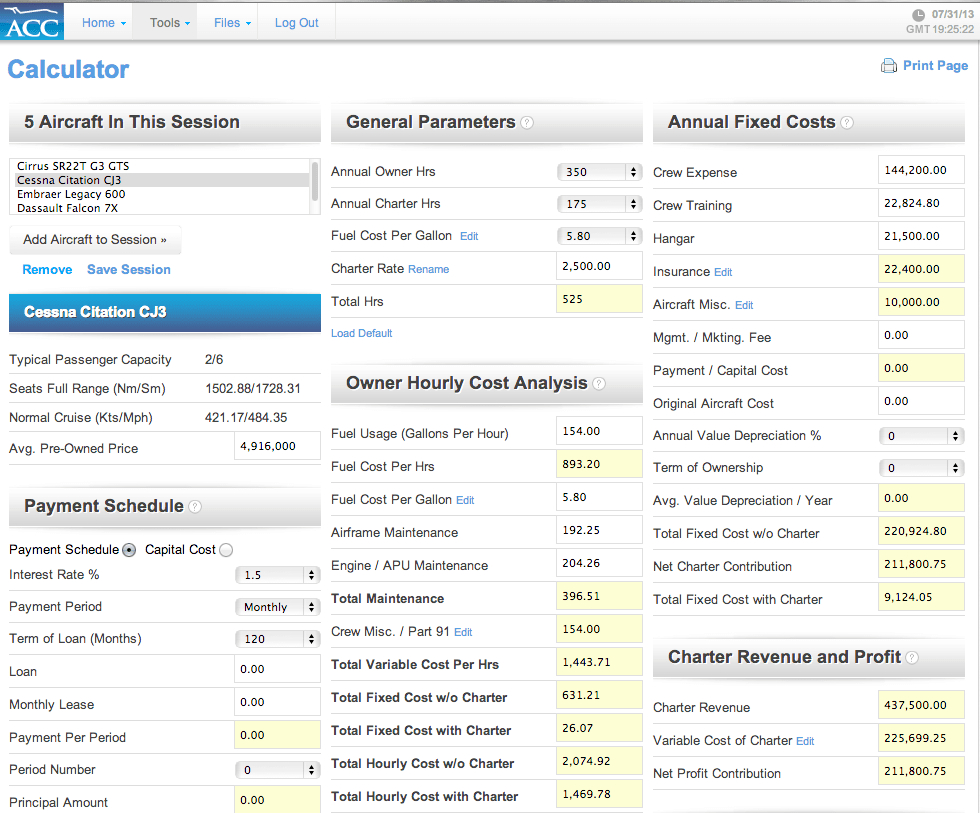

Calculators

Contact your lender to receive a more accurate loan payoff amount which will include interest, principal and potentially a prepayment... Penalty amounts are usually expressed as a percent of the outstanding balance at the time of prepayment or a specified number of months of interest. The penalty amount typically decreases with time until it phases out eventually, normally within 5 years.

It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. For example, if a mortgage rate is 6% APR, it means the borrower will have to pay 6% divided by twelve, which comes out to 0.5% in interest every month. For example, your mortgage lender requires that you get mortgage insurance if you put less than 20% down. You pay for a lender's title insurance policy along with other mortgage costs, and may want to buy an owner's title policy, too. If your property is in a flood zone you'll be required to buy flood insurance as well.

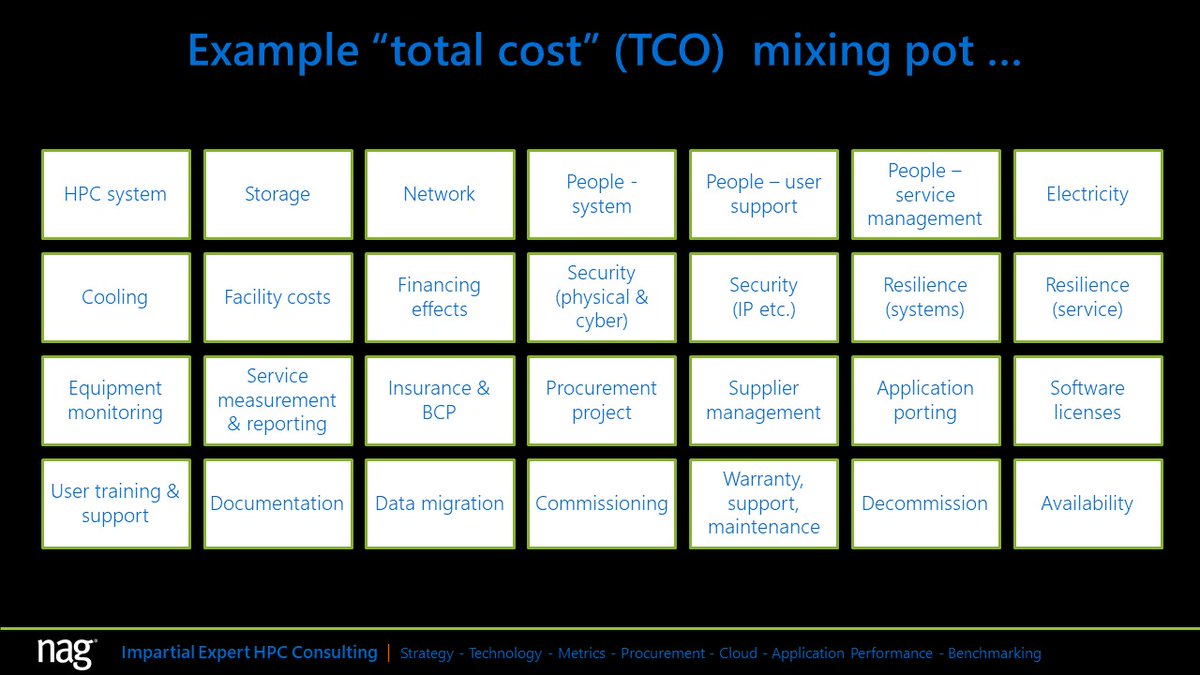

How to Calculate Total Cost of Ownership

According to Angi’s State of Home Spending report, homeowners spent an average of $10,400 on remodeling projects in 2021. Ongoing maintenance, repairs, and renovations vary based on the age, size, and style of our home. In contrast, a tax credit would deduct $5,000 from the amount of taxes you owe or would give you $5,000 if you owed no taxes. You can deduct money from the amount you owe by claiming certain recognized deductions from your bill.

One of the many homeownership benefits is being able to change the color of your kitchen cabinets or replace those wall-to-wall carpets. While costs widely vary, the 10 most popular home renovation projects cost anywhere from a few hundred to several thousand dollars. Down payments can range anywhere from 3% to 20%, depending on your loan type and the home’s sale price. There are low down payment mortgage options that make it possible to buy a home with less money down. Buying a home costs between 3% and 6% of the price in closing costs and up to 20% for the down payment. If you work from home for any part of the time, you can also deduct your mortgage expenses from your taxes.

Renovation and Remodeling Costs

Enter a ZIP Code, select your home's current age, and click "Apply" above to see results. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

Then plug in your state and federal tax rate and your standard deductions. We’ll e-mail you a complete financial analysis of what you can save in the coming years based on the interest you pay. Closing costs—the fees paid at the closing of a real estate transaction. These costs typically fall on the buyer, but it is possible to negotiate a "credit" with the seller or the lender. It is not unusual for a buyer to pay about $10,000 in total closing costs on a $400,000 transaction. When you take out a mortgage, you have the ability to repay it over a predetermined term .

In 2018 the standard deduction for individuals or married people filing individually is $12,000. The standard deduction for a head of household is $18,000 & the standard deduction for married couples filing jointly is $24,000. Further, the combined limit on deducting property taxes with state income or sales tax will be set to $10,000 per year. In 2021 the standard deduction for individuals or married people filing individually is $12,550.

But, few consider these factors as part of the price during their selection process. The price tag can cause much confusion because it reflects one small part of the big picture. Some sources say that the amount on the price tag represents less than 10 percent of the total cost spent on a piece of equipment over its lifetime. Unlock helps everyday American homeowners that have been left behind by the traditional home and finance system. The blog articles published by Unlock Technologies are available for informational purposes only and not considered legal or financial advice on any subject matter. The blogs should not be used as a substitute for legal or financial advice from a licensed attorney or financial professional.

In fact, 83% of sellers make a concession to finalize an offer according to the Zillow Group... Many homeowners avoid capital gains taxes when selling their primary home by qualifying for the capital gains tax exemption. First, you must have lived in the home for at least two of the last five years... Sellers make a one-time payment for the new owner's title insurance at closing. This insurance protects the new owner of the home from any disputes over claim to the title of the property or outstanding... Your listing agent commission usually covers online listing fees, professional photography and videography, advertising on social media and open house expenses such as yard signs, listing flyers...

It is all neatly printed out in organized boxes so that you can follow instructions on the other forms as you fill it out. Remember, it is up to you as a taxpayer to file your taxes on time. By default 30-yr fixed-rate refinance loans are displayed in the table below.

Don't leave these expenses out when budgeting for the actual cost of owning a house. Interest is the other big player influencing how much you'll eventually pay to satisfy your vehicle installment loan. Rates are expressed as APR, or annual percentage rate, providing the basis for calculations determining your periodic payments. Car financing interest rates are low, with occasional offers bringing the cost of financing all the way down to 0%. One way car-buyers save money on purchases is to track rates for the best deals, jumping in to the car market when conditions are most favorable. When buying a car most people fail to consider ALL of the expenses that will be generated by their purchase.

Here's an appliance budgeting worksheet from Freddie Mac that illustrates how much you may have to come up with soon after closing on your home purchase. You can also estimate the age of some major appliances using this tool. If this sounds like a lot of money to have to come up with each year, it's important to know that you are unlikely to spend all of that cash every year. A roof or heating system replacement done this year may never have to be done again in the time you own your home, for example. These costs are spread out over your home ownership period, but unfortunately, you usually have to pay for them up front .

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. This free calculator lets you find out how much you are spending on your home in monthly recurring costs and how that compares to what others are spending. Yes, there are many costs to owning a home that people might forget about when purchasing one.

No comments:

Post a Comment